If one of your goals for the new year is to cut down on spending, you're not alone. Waving more and spending less money was one of the top New Year's resolutions for 2019, according to a poll by Inc.

But as with so many resolutions, it's hard to know where to start. You may not even be sure how much you're spending, or where all your money is going. Nearly half of Americans spend as much as or more than they're actually making, according to the Center for Financial Services Innovation, which leaves them without any financial cushion. The Federal Reserve Board reports that 40% of Americans couldn't cover an unexpected $400 expense. Not only is this financial stress risky, but it can also have a lasting impact on your health.

So there's no better time to commit to that resolution to be smarter with your spending. It will benefit your bank account and could improve your mental and physical health. And that sounds like a resolution we can stand by.

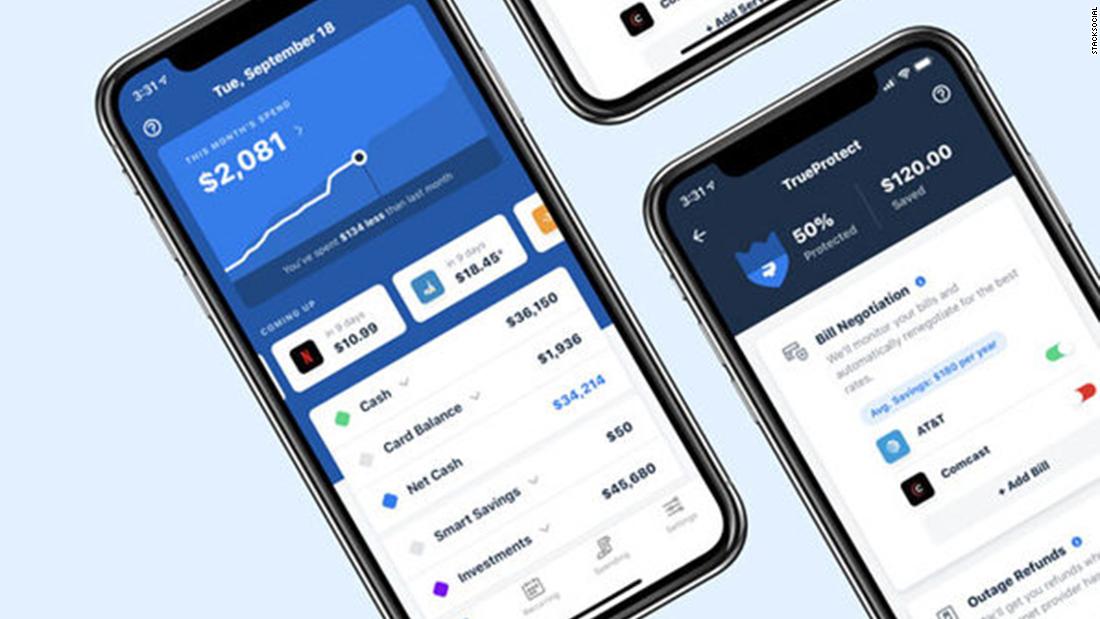

Truebill ($19.99 for a one-year subscription, originally $35.99; stacksocial.com) is a personal finance app that aims to help you gain total control of your spending. The app connects to your accounts to give you a quick yet complete look of all your finances, so you can easily see your cash, credit and investment balances in one place. You can access reports that categorize your expenses to help you better understand where your money is being spent.

But that's not all -- the app also aims to help you cut spending right away. You can manage and cancel any unwanted subscriptions, giving you the chance to consider which services are necessary and which you can do without. Truebill can also help negotiate lower rates for your cell phone, cable and other bills. You also have the option to automatically set aside funds to help you with any specific goals you set.

And there's no need to worry about the safety of your financial information or accounts. Truebill securely connects to your accounts using bank-level security with 256-bit SSL encryption and read-only access.

The company says it's already helped people save over $14 million, and it's been featured in publications from Forbes to the Los Angeles Times. And right now, you'll save 44% on a one-year subscription ($19.99, originally $35.99; stacksocial.com) or 53% on a three-year subscription ($49.99, originally $107.97; stacksocial.com). Happy saving!

from CNN.com - RSS Channel https://cnn.it/2M7wJB4

No comments:

Post a Comment