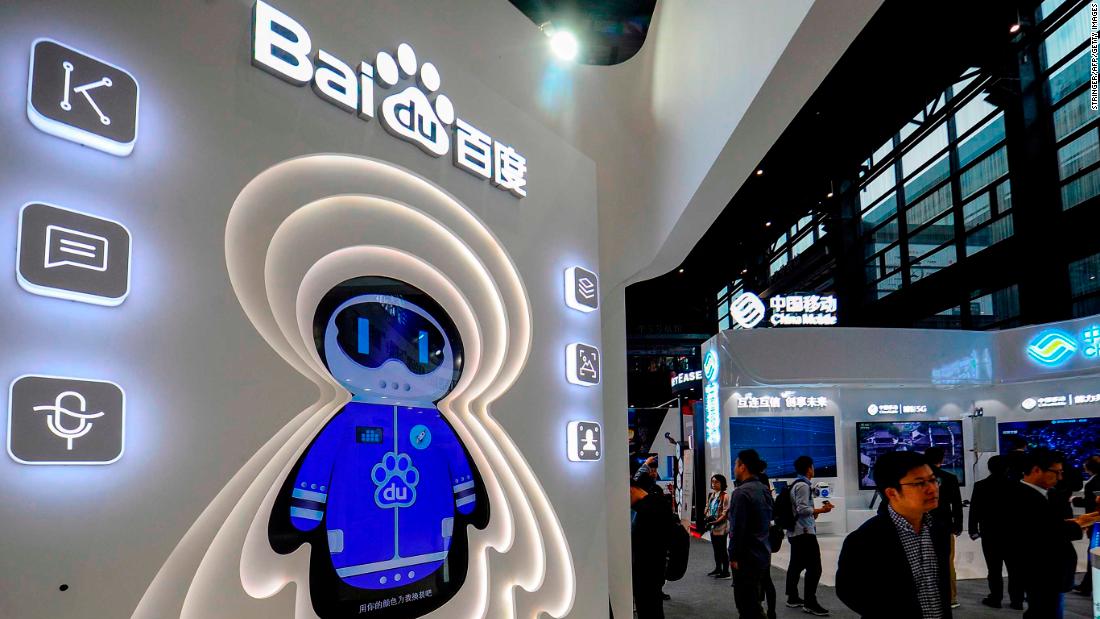

Disappointing earnings from the first three months of 2019 sent shares of the US-listed Chinese tech company tumbling more than 10% in premarket trading Thursday.

The company pointed to a "challenging environment" for online ad revenue, citing economic weakness in China and tighter regulation of internet content. That's hurt its core search business.

China's economic growth has slumped to a near three-decade low in recent months, as the country grapples with an escalating trade war against the United States and tries to rein in high levels of debt. Rivals Tencent (TCEHY) and Alibaba (BABA), which posted solid earnings this week, have fared better.

2. Pound punished: Brexit uncertainty is back on the menu in the United Kingdom, driving the pound down Friday below $1.28 to its lowest level against the dollar since January. It has also notched its longest string of losses against the euro since 2000, according to currency trading firm FXTM.

Prime Minister Theresa May is now expected to lay out a timetable for her departure following a fourth attempt to win parliamentary support for her Brexit plan in early June. This sets up questions about who will succeed her.

The risk of the United Kingdom crashing out of the European Union in October without a deal is also rising after talks between May and the opposition Labour Party collapsed on Friday.

3. Market mood: Solid earnings and economic news have helped prop up US markets in recent days. That's not the case in Europe and Asia on Friday, where the escalating US-China trade war is once again weighing down shares.

A new US barrage against Chinese tech giant Huawei this week has reduced the chances of an early resolution to the damaging dispute between the world's top two economies.

Hong Kong's Hang Seng index fell almost 1.2% Friday, while the Shanghai Composite index dropped nearly 2.5%. South Korea's KOSPI index shed 0.6%. Japan was the exception, with the Nikkei rising 0.9%.

European markets also opened lower. Britain's FTSE lost almost 0.2%. Markets in Germany and France fell 0.6% and 0.3%, respectively.

US markets are also set to open lower following a third consecutive day of gains. The Dow is set to open 88 points lower, falling 0.3%. The Nasdaq could drop 0.5%, and the S&P 500 is poised to lose 0.4%.

The Dow jumped 215 points, or 0.8%, on Thursday on solid earnings from companies like Walmart (WMT) and upbeat economic reports on manufacturing activity, housing starts and jobless claims. The S&P 500 rose 0.9%, and the Nasdaq jumped 1%.

4. Companies: UK food delivery company Deliveroo said Friday that it raised $575 million in a new round of funding led by Amazon (AMZN). It's another big move into food from the internet retailer, and expands Amazon's global reach.

Shares of Deliveroo competitor Just Eat (JSTTY) fell 7% in early trading. Uber (UBER) is also a big competitor in the UK food market.

China's Luckin Coffee (LK), meanwhile, expects to make its Wall Street debut Friday. The company, which wants to oust Starbucks (SBUX) as China's biggest coffee chain, intends to more than double the its store numbers by the end of the year. Luckin will trade on the Nasdaq under the ticker LK.

5. Coming this week:

Friday — US consumer sentiment

Friday — US consumer sentiment

No comments:

Post a Comment